A Better Explanation Of The Endowment Effect

It’s a famous study. Give a mug to a random subset of a group of people. Then ask those who got the mug (the sellers) to tell you the lowest price they’d sell the mug for, and ask those who didn’t get the mug (the buyers) to tell you the highest price they’d pay for the mug. You’ll find that sellers’ minimum selling prices exceed buyers’ maximum buying prices by a factor of 2 or 3 (.pdf).

This famous finding, known as the endowment effect, is presumed to have a famous cause: loss aversion. Just as loss aversion maintains that people dislike losses more than they like gains, the endowment effect seems to show that people put a higher price on losing a good than on gaining it. The endowment effect seems to perfectly follow from loss aversion.

But a 2012 paper by Ray Weaver and Shane Frederick convincingly shows that loss aversion is not the cause of the endowment effect (.pdf). Instead, “the endowment effect is often better understood as the reluctance to trade on unfavorable terms,” in other words “as an aversion to bad deals.” [1]

This paper changed how I think about the endowment effect, and so I wanted to write about it.

Behavioral Science, Democratized

We make 35,000 decisions each day, often in environments that aren’t conducive to making sound choices.

At TDL, we work with organizations in the public and private sectors—from new startups, to governments, to established players like the Gates Foundation—to debias decision-making and create better outcomes for everyone.

A Reference Price Theory Of The Endowment Effect

Weaver and Frederick’s theory is simple: Selling and buying prices reflect two concerns. First, people don’t want to sell the mug for less, or buy the mug for more, than their own value of it. Second, they don’t want to sell the mug for less, or buy the mug for more, than the market price. This is because people dislike feeling like a sucker. [2]

To see how this produces the endowment effect, imagine you are willing to pay $1 for the mug and you believe it usually sells for $3. As a buyer, you won’t pay more than $1, because you don’t want to pay more than it’s worth to you. But as a seller, you don’t want to sell for as little as $1, because you’ll feel like a chump selling it for much less than it is worth. [3]. Thus, because there’s a gap between people’s perception of the market price and their valuation of the mug, there’ll be a large gap between selling ($3) and buying ($1) prices:

Weaver and Frederick predict that the endowment effect will arise whenever market prices differ from valuations.

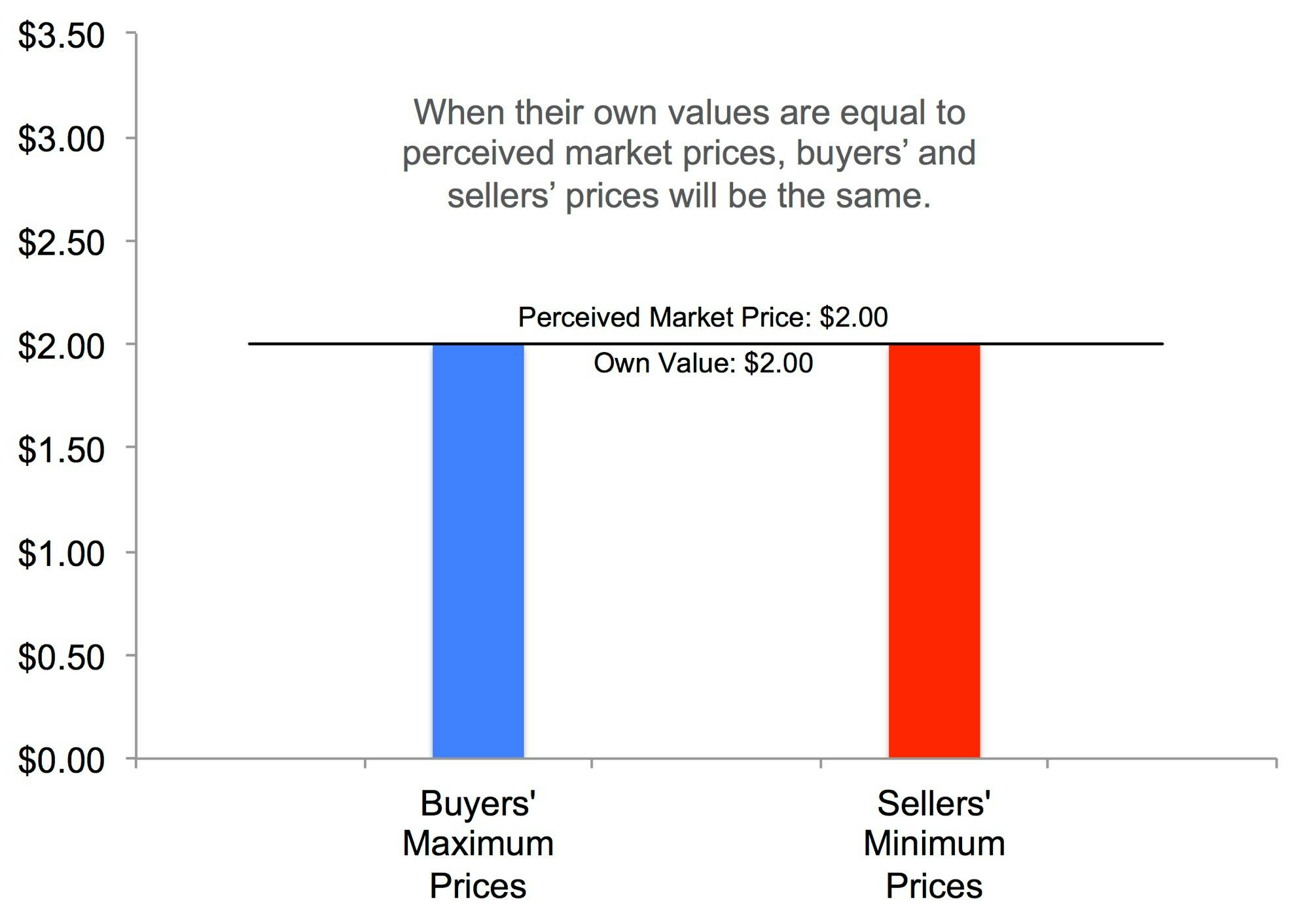

However, when market prices are not different from valuations, you shouldn’t see the endowment effect. For example, if people value a mug at $2 and also think that its market price is $2, then both buyers and sellers will price it at $2:

And this is what Weaver and Frederick find. Repeatedly. There is no endowment effect when valuations are equal to perceived market prices. Wow.

The AI Governance Challenge

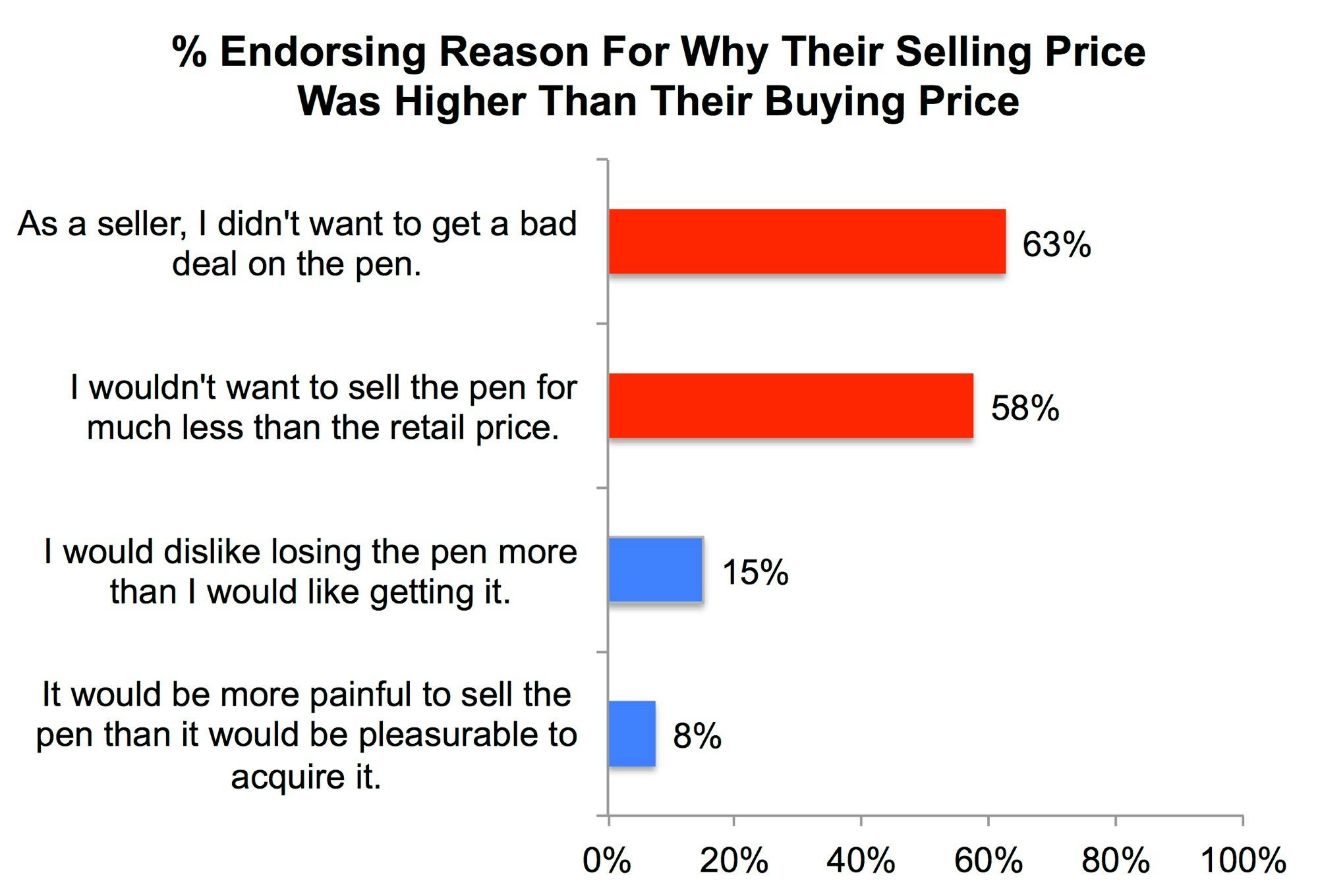

Just to be sure, I ran a within-subjects hypothetical study that is much inferior to Weaver and Frederick’s between-subjects incentivized studies, and, although my unusual design produced some unusual results, I found strong support for their hypothesis (full description .pdf; data .xls). Most importantly, I found that people who gave higher selling prices than buying prices for the same good were much more likely to say they did this because they wanted to avoid a bad deal than because of loss aversion:

In fact, whereas 82.5% of participants endorsed at least one bad-deal reason, only 18.8% of participants endorsed at least one loss-aversion reason. [4]

I think Weaver and Frederick’s evidence makes it difficult to consider loss aversion the best explanation of the endowment effect. Loss aversion can’t explain why the endowment effect is so sensitive to the difference between market prices and valuations, and it certainly can’t explain why the effect vanishes when market prices and valuations converge. [5]

Weaver and Frederick’s theory is simple, plausible, supported by the data, and doesn’t assume that people treat losses differently than gains. It just assumes that, when setting prices, people consider both their valuations and market prices, and dislike feeling like a sucker.

Notes:

- Even if you don’t read Weaver and Frederick’s paper, I strongly advise you to read Footnote 10.

- Thaler (1985) called this “transaction utility” (.pdf). Technically Weaver and Frederick’s theory is about “reference prices” rather than “market prices”, but since market prices are the most common/natural reference price I’m going to use the term market prices.

- Maybe because you got the mug for free, you’d be willing to sell it for a little bit less than the market price – perhaps $2 rather than $3. Even so, if the gap between market prices and valuations is large enough, there’ll still be an endowment effect.

- For a similar result, see Brown 2005 (.pdf).

- Loss aversion is not the only popular account. According to an “ownership” account of the endowment effect (.pdf), owning a good makes you like it more, and thus price it higher, than not owning it. Although this mechanism may account for some of the effect (the endowment effect may be multiply determined), it cannot explain all the effects Weaver and Frederick report. Nor can it easily account for why the endowment effect is observed in hypothetical studies, when people simply imagine being buyers or sellers.